Founded in 2021 with the mission to build a $1B wealth platform, Sigma Edge Capital applies deep quantitative research, momentum-driven models, and disciplined risk management to achieve long-term compounding at 25% annual ROI.

SigmaEdge Capital provides innovative and data-driven financial solutions, enabling businesses and investors to optimize capital growth, manage risk effectively, and achieve sustainable financial performance. Our expertise integrates advanced analytics, AI-driven financial modeling, and strategic investment frameworks to deliver high‑impact results in the financial sector. We have also collaborated with IIT Delhi, leveraging their research excellence in data science, artificial intelligence, and computational finance. This collaboration strengthens our analytical capabilities and supports the development of advanced financial technologies and decision‑support systems.

The philosophy behind Sigma Edge Capital was born from a simple statement: "Make a money tree." This idea led to two years of deep study in quantitative finance, statistics, probability, and algorithmic modelling. The result: Sixer Short — our proprietary quant momentum strategy inspired by Jim Simons, built on 25 years of backtested market data.

Starting with ₹1 crore in seed capital, our goal is clear — to build a $1 billion investment firm within the next two decades through consistent compounding and disciplined execution.

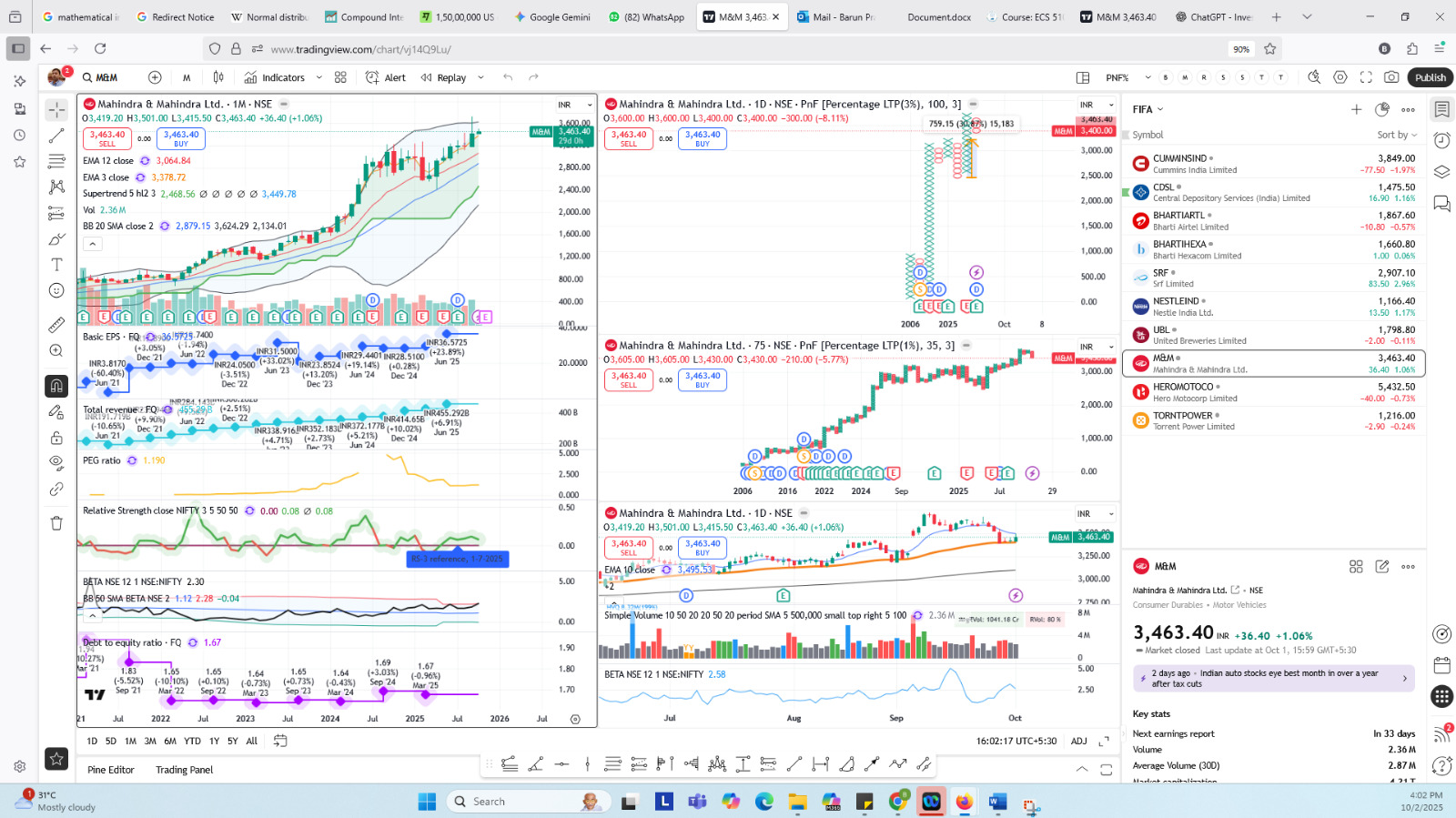

At the heart of our firm lies Sixer Short, a momentum-driven quantitative model that combines Gaussian distribution, Two Sigma deviation theory, and advanced probability systems to identify high-conviction trades with precision.

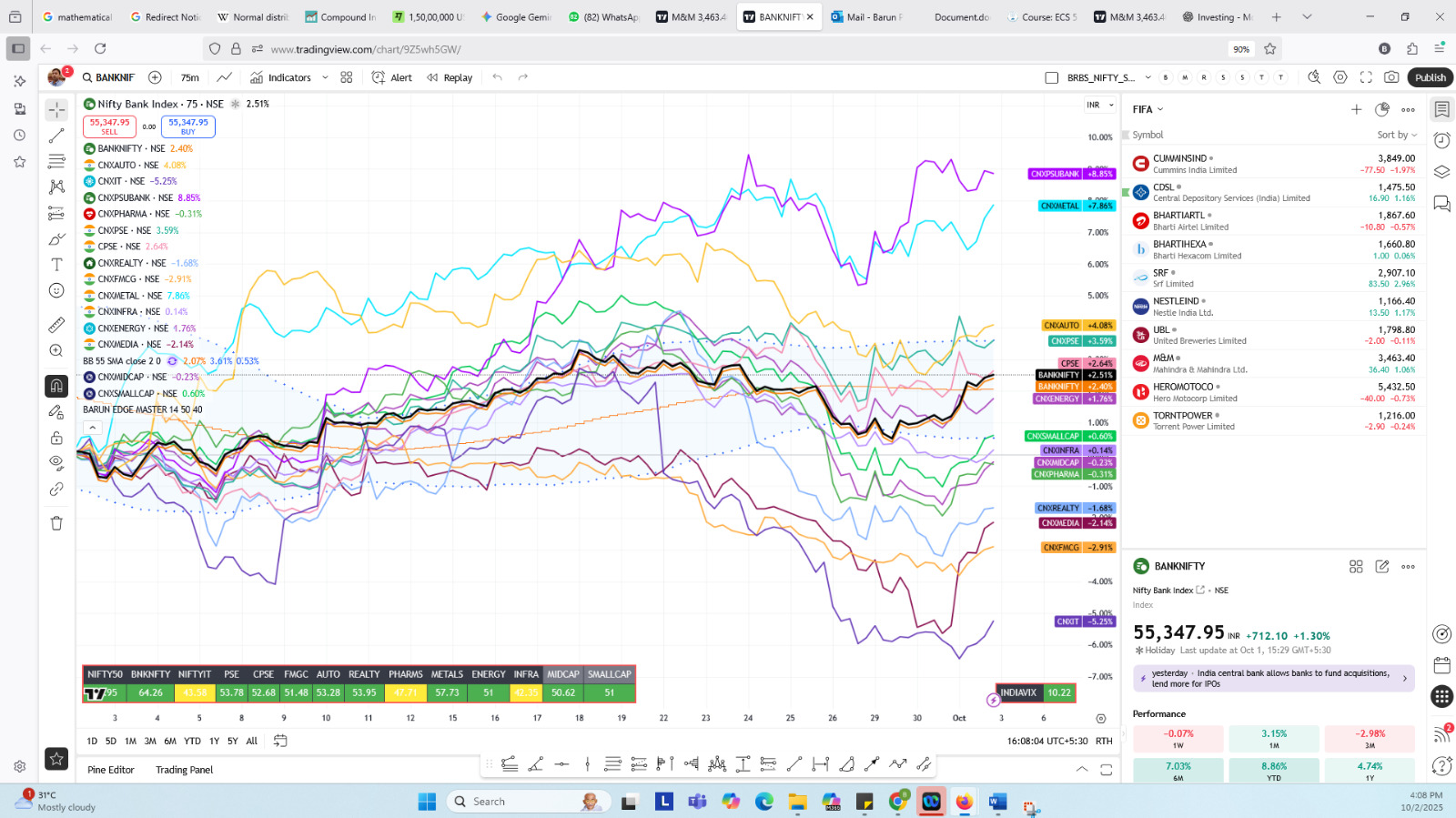

Global & Indian trend analysis.

Sector rotation & momentum scoring.

Risk control & volatility metrics.

Fundamental validation.

Dynamic allocation models.

Backtesting & stress tests.

This approach combines Point & Figure (PNF) charts with Candlestick patterns, enabling the identification of both long-term momentum and short-term price movements. It integrates key elements such as the VCP (Volatility Contraction Pattern), valuation metrics, volatility analysis, and the overall financial health of the company, helping investors make informed and timely decisions.

We apply advanced quantitative frameworks including Gaussian models, Monte Carlo simulations, CLT-based predictive modelling, and Bayesian probability systems. Every strategy undergoes multi-dataset stress testing to ensure consistency, scalability, and robustness.

Request a pitch, inquire about fund availability, or schedule a meeting with our team.